40+ 15 year conventional mortgage calculator

Current Mortgage and Refinance Rates. A 40-year mortgage extends the mortgage term by 10 years when compared with a traditional 30-year mortgage.

Pin On Money Things

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float.

. Thats about two-thirds of what you borrowed in interest. Well also compare payments between 10-year 15-year and 30-year fixed-rate mortgages. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. 15 Year Fixed 30 Year FHA 30 Year Jumbo 51 ARM. Most people need a mortgage to finance a home purchase.

Therefore the rate and. A 10-year fixed mortgage is a home loan thats paid within a period of 10 years. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate.

As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

51 Arm Mortgage Rates. Explore the benefits of getting a 30-year fixed and apply today. 10-year mortgages tend to be priced at roughly 05 to 10 lower than 30-year mortgages.

Well also explain when its a good idea to choose this type of loan and when it makes sense to refinance to a shorter term. Your total interest on a 250000 mortgage. Assuming you have a 20 down payment 140000 your total mortgage on a 700000 home would be 560000.

These types of mortgage are not federally backed by the government. On the above house loan calculator you can see that it allows you to select a loan term length of loan anywhere from 10 years all the way to 30 years. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

Nearly 90 of them opt for a 30-year fixed rate loan. Depending on your financial situation one term may be better for you than the other. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1257 monthly payment.

A reverse mortgage is a mortgage loan. Find average jumbo mortgage rates for the 30 year fixed rate mortgage from Mortgage News Daily. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

A 40-year mortgage with a variable rate Borrowers can get an adjustable-rate mortgage ARM with a 40-year term. The following table lists historical average annual mortgage rates for conforming 30-year mortgages. Going this route can make portfolio.

In 2016 and 2017 many younger borrowers across the UK have moved away from. The 30-year fixed mortgage is a great way to buy or refinance a home. Most prospective borrowers choose either a 15-year mortgage or a 30-year mortgage.

A 6040 mix of stocks and bonds is a classic asset allocation but does it make sense for your portfolio. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. The average 51 adjustable-rate mortgage ARM rate is 4520 with an APR of 6300.

Fixed-rate 40-year Home Loan Calculator. One of the more conventional approaches financial advisors and experts suggest is the 6040 portfolio. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals.

Historical 30-YR Mortgage Rates. You can obtain them from private lenders such as banks credit. For the fiscal year ending September 2011 loan volume had contracted in the wake of the financial crisis but remained at over 73000 loans that were originated and insured through the HECM program.

An ARM has a fixed rate for a set time for example five seven or 10 years and then adjusts periodically for the remaining. Both selections have a marked effect on the interest rate you are offered. Assuming you have a 20 down payment 70000 your total mortgage on a 350000 home would be 280000.

I will automatically calculate you a year older. Your monthly payments will be less for a 30year fixed loan than a 15-year fixed loan even though interest rates for a 15-year fixed loan are generally a little lower. You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options.

The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgages. 2008 the annual volume of HECM loans topped 112000 representing a 1300 increase in six years. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 2515 monthly payment.

Dont forget to include your spouses age even if they are not yet 62 as loan proceeds are always based on the age of the youngest spouse. The average 15-year fixed mortgage rate is 5310 with an APR of 5350. 71 Arm Mortgage Rates.

Understanding How 10-Year Fixed Mortgages Work. Home Price Downpayment. Simple Mortgage Calculator.

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

20 Beautiful Small Bathroom Ideas Small Full Bathroom Bathroom Layout Small Bathroom With Shower

How To Get A Mortgage With Bad Credit Comparewise

How To Use A Mortgage Calculator Comparewise

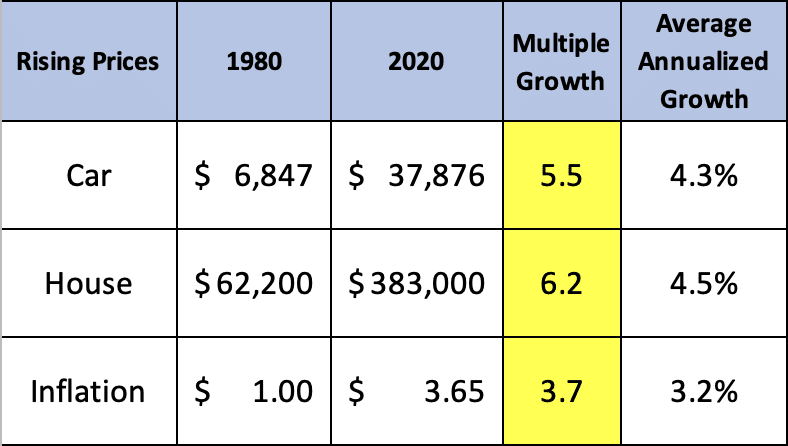

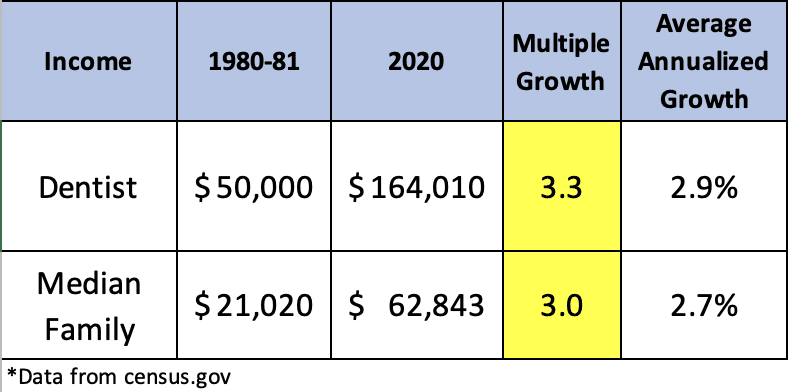

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

How Much Savings Should I Have By 40 A Retirement Savings Guide

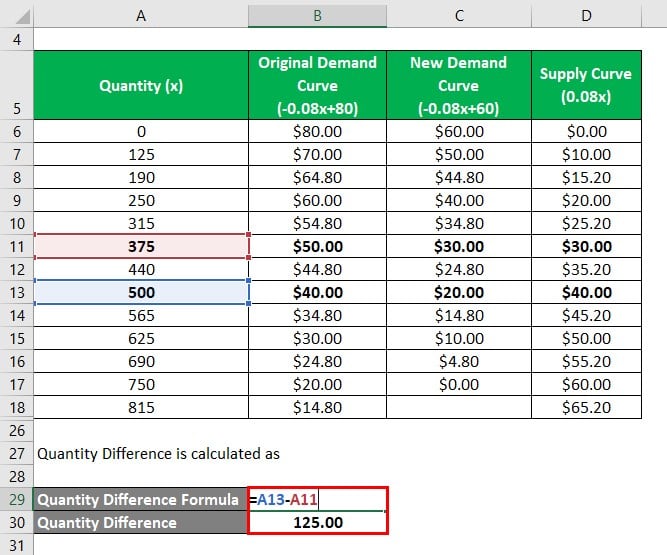

Deadweight Loss Formula How To Calculate Deadweight Loss

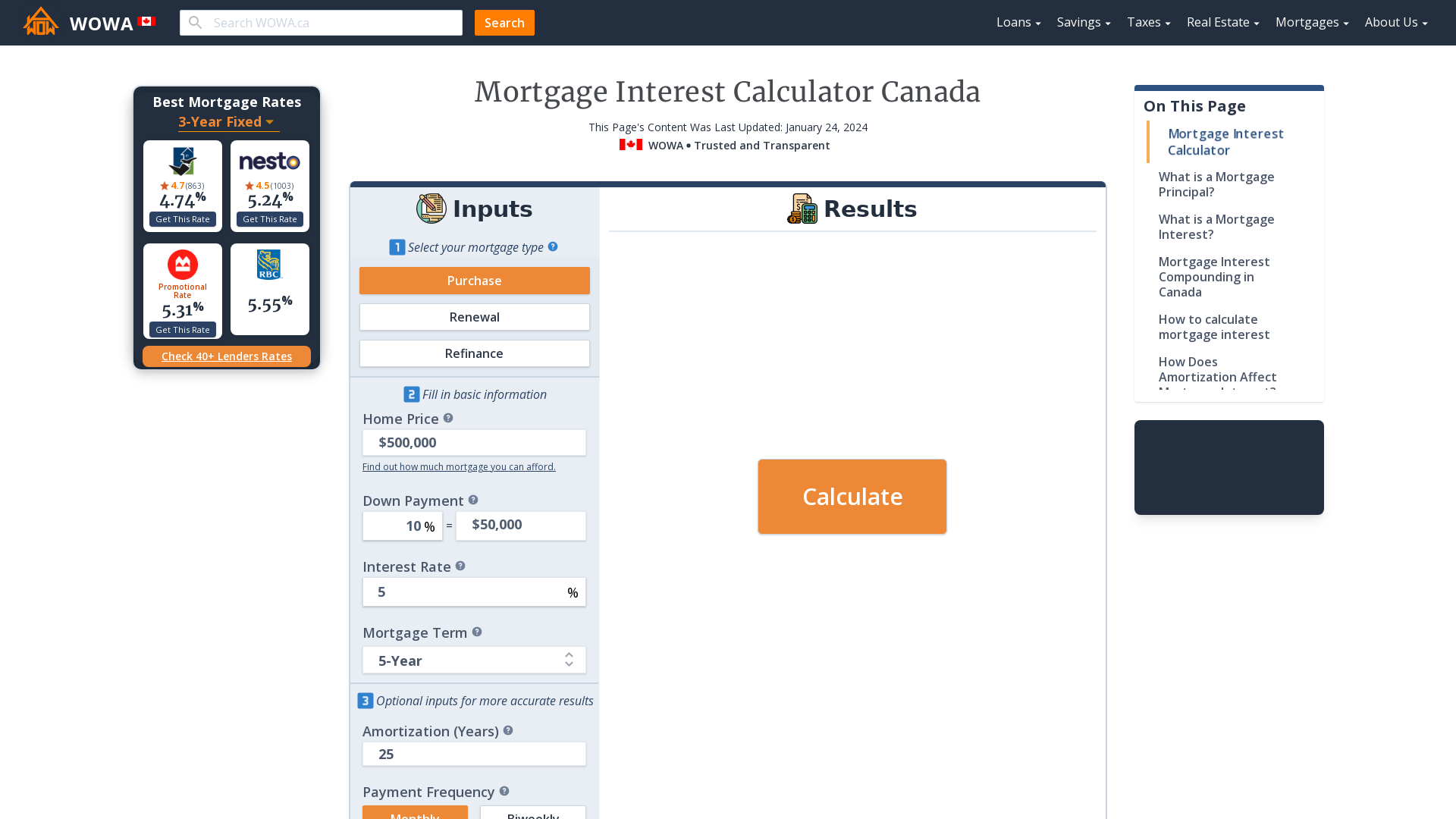

Mortgage Interest Calculator Principal And Interest Wowa Ca

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

How Much Do Traders Make On A Monthly Basis Quora

5 Free Personal Yearly Budget Templates For Excel Excel Budget Template Personal Budget Template Budget Template Excel Free

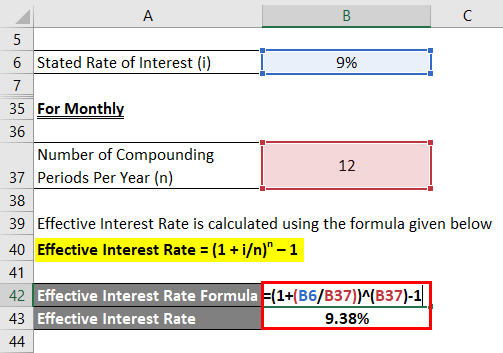

Effective Interest Rate Formula Calculator With Excel Template

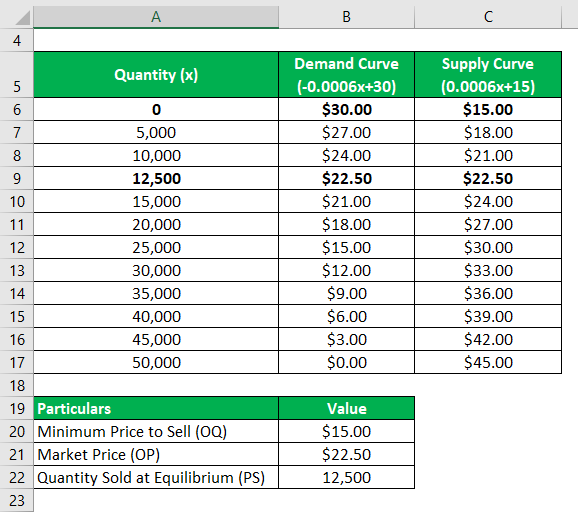

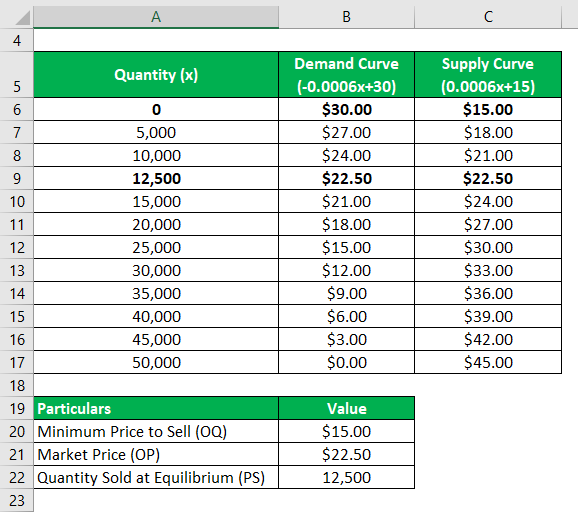

Producer Surplus Formula Calculator Examples With Excel Template

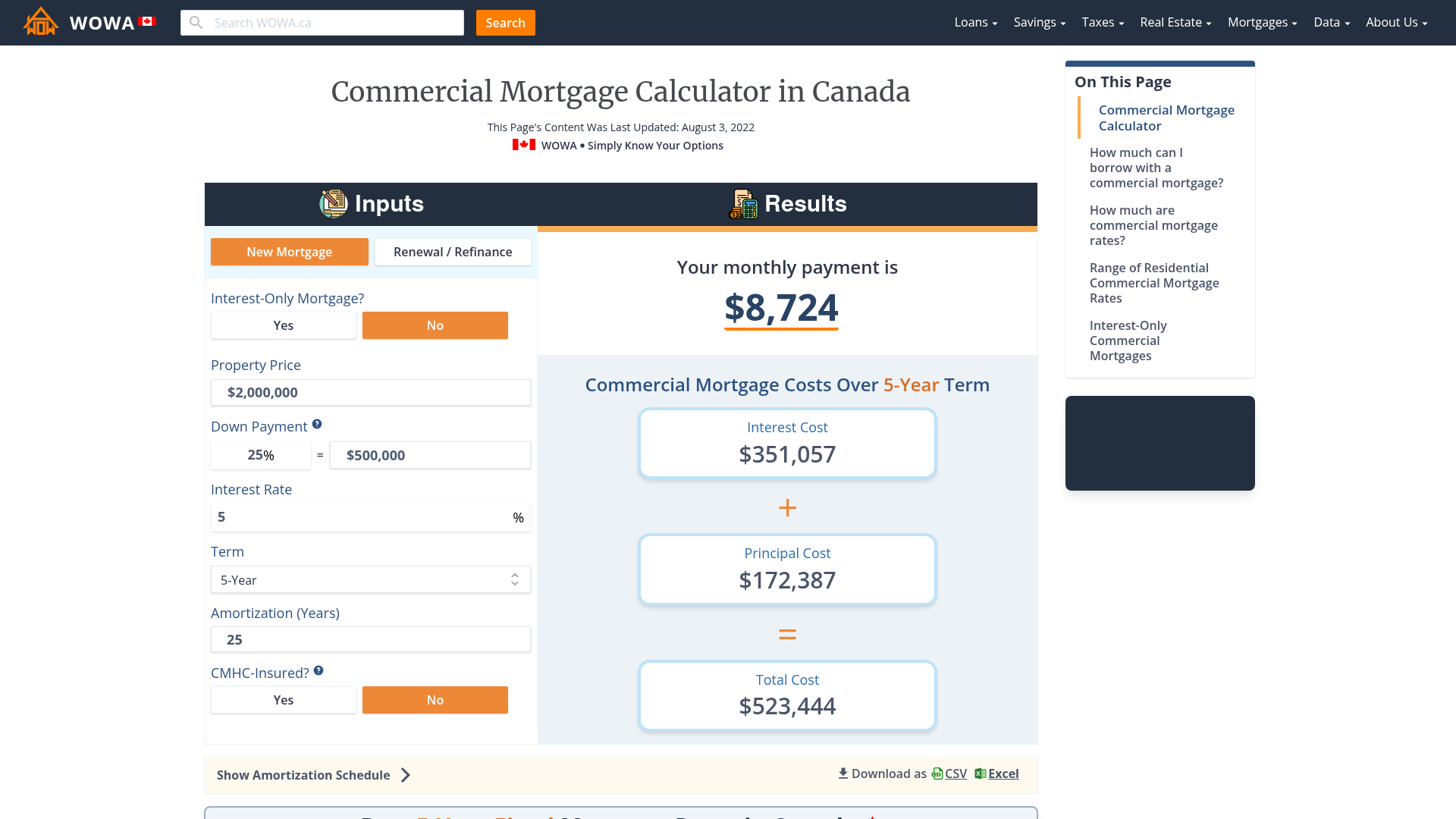

Commercial Mortgage Calculator Payment Amortization

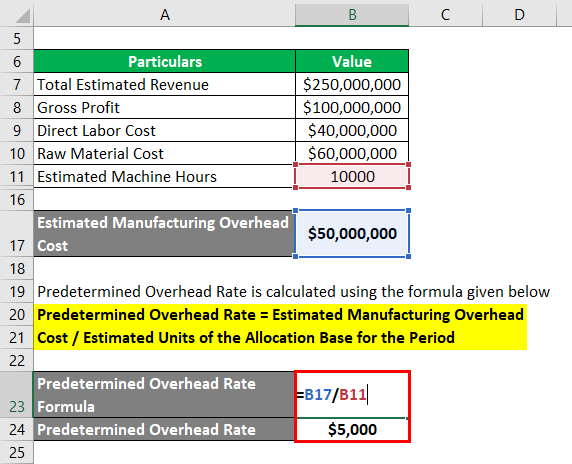

Predetermined Overhead Rate Formula Calculator With Excel Template

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

Ykyn2lcfj1k0wm